A Deep Dive into AI-Driven Market Forecasting

The stock market is a constantly shifting landscape influenced by macroeconomic trends, corporate earnings, political events, and investor sentiment. Traditional forecasting methods—such as technical analysis and fundamental analysis—rely heavily on historical data and human interpretation. However, these methods often fail to react quickly to real-time market fluctuations.

In response to this challenge, financial institutions have started integrating Artificial Intelligence (AI) and machine learning into their predictive models. AI-driven approaches have the potential to detect patterns that human analysts may overlook, enabling faster, data-backed decision-making.

This case study examines how AI is being applied in stock forecasting, the challenges involved, and its growing impact on financial markets, algorithmic trading, and investment strategies.

How AI Models Are Used in Stock Forecasting

AI-powered stock market prediction techniques rely on different machine learning models, each offering unique advantages:

Deep Learning & Time Series Forecasting (LSTM)

- Long Short-Term Memory (LSTM) networks have become a widely adopted model for stock market predictions.

- Unlike traditional regression-based models, LSTMs can capture long-term dependencies in stock price movements, making them ideal for short-term trading strategies.

- Financial institutions and hedge funds use LSTM models to predict trends based on:

- Historical price data

- Market volume and volatility indicators

- Macroeconomic factors (interest rates, inflation, GDP growth)

Graph: Stock Market Prediction – AI vs. Traditional Moving Average

- Black Line: Actual stock prices over 100 days.

- Blue Dashed Line: AI-predicted stock prices using machine learning.

- Red Dotted Line: Traditional 5-day moving average as a benchmark.

This highlights how AI predictions fluctuate more dynamically than moving averages, adapting to sudden market changes. In real-world applications, these models can enhance short-term trading decisions by identifying trends earlier.

Sentiment Analysis for Market Trends

Stock prices aren’t just driven by numbers—public sentiment and media coverage play a major role in influencing investor behavior. AI-powered Natural Language Processing (NLP) models analyze sentiment from:

- Financial news articles

- Social media platforms (Twitter, Reddit, stock forums)

- Earnings reports and corporate filings

Example: AI models analyzing Twitter sentiment have been able to anticipate market shifts, particularly when influential figures like Elon Musk make statements about stocks or cryptocurrencies.

- Green & Red Bars: Sentiment analysis scores (positive = green, negative = red) extracted from financial news and social media.

- Blue Line: Corresponding stock price movement over the same period.

Key Insight:

- Positive sentiment spikes (green bars) often align with stock price increases.

- Negative sentiment dips (red bars) tend to precede price declines.

- AI-driven sentiment analysis helps anticipate market movements before they happen.

Reinforcement Learning & Algorithmic Trading

- Some AI models use reinforcement learning, a technique where the AI “learns” from real-time market conditions and adapts its trading strategies dynamically.

- These models continuously optimize their performance by simulating trades, learning from past wins and losses.

Example:

- JPMorgan Chase and Goldman Sachs employ AI-based models to analyze market conditions and dynamically adjust trading portfolios.

- AI-driven robo-advisors such as Wealthfront and Betterment use machine learning to automate investment decisions for retail investors.

Challenges & Limitations of AI in Stock Market Predictions

Despite AI’s potential, predicting the stock market remains an incredibly difficult task due to:

- Market Unpredictability → AI models struggle to predict black swan events (e.g., financial crises, pandemics, or regulatory changes).

- Overfitting to Past Data → Many AI models perform well on historical datasets but struggle in real-world trading scenarios.

- Regulatory & Ethical Concerns → AI-driven trading raises concerns about market manipulation, flash crashes, and unequal advantages for institutional investors.

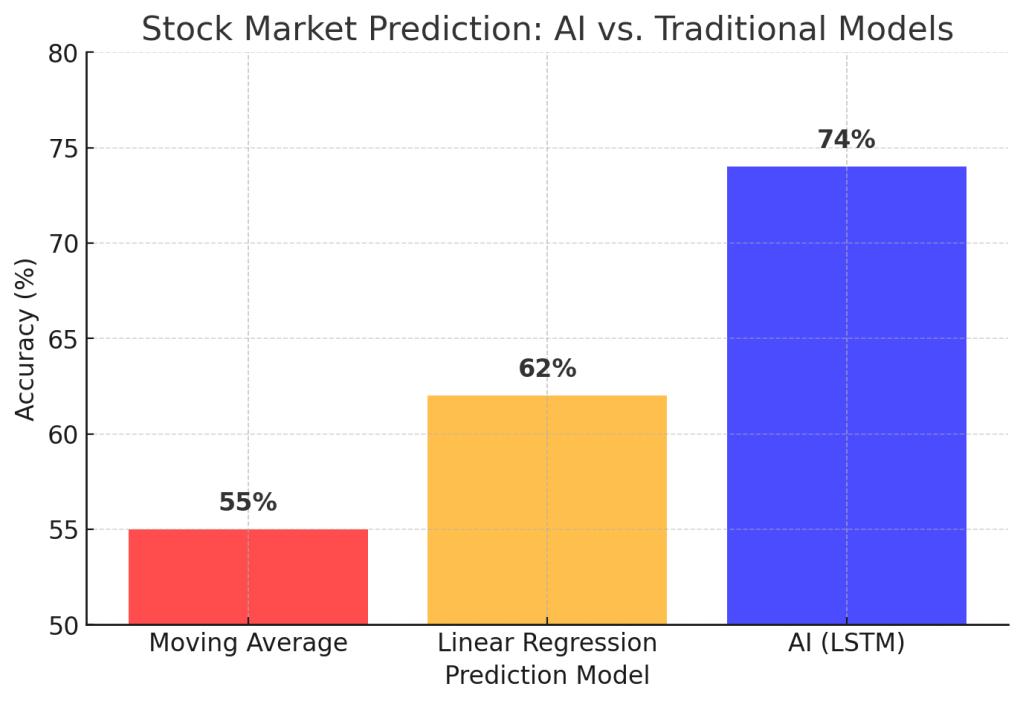

Performance Comparison: AI vs. Traditional Methods

To better understand AI’s effectiveness, let’s compare its predictive accuracy with traditional stock forecasting models.

Graph: AI vs. Traditional Stock Prediction Models

- Moving Average (55%) – Common technical analysis method with limited adaptability.

- Linear Regression (62%) – Basic machine learning approach with some improvements.

- AI (LSTM, 74%) – Deep learning model demonstrating superior accuracy in trend forecasting.

Key Takeaway: AI significantly outperforms traditional methods, offering greater adaptability and responsiveness to market trends.

Business Impact of AI in Financial Markets

AI is already transforming how hedge funds, retail investors, and financial institutions operate.

The key benefits include:

- Increased Trading Efficiency – AI models process vast amounts of financial data faster than human traders.

- Risk Mitigation – AI-powered portfolio management helps hedge against downturns and optimize asset allocation.

- Improved Market Insights – AI enables data-driven decision-making, helping investors spot opportunities early.

While AI cannot perfectly predict the stock market, it provides valuable insights that shape modern trading strategies and investment portfolios.

Looking Ahead: The Future of AI in Finance

As AI technology continues to evolve, we can expect:

- More advanced reinforcement learning models that can adapt in real-time.

- Greater use of alternative data sources (e.g., Google search trends, consumer spending data, satellite imagery).

- Increased regulatory oversight to ensure fair and ethical AI trading practices.

AI in stock forecasting is not about replacing human investors—instead, it is becoming an essential decision-making tool that enhances financial strategies with data-driven intelligence.

AI-powered stock market predictions are already shaping the future of investing, offering sophisticated tools that analyze data at speeds beyond human capability. However, stock markets remain influenced by unpredictable factors—and no AI model can fully eliminate risk.

For investors, the key takeaway is clear: AI is not a crystal ball, but it is a powerful tool for making smarter, data-backed financial decisions.